Recently I received an email from a tower named William. He was fed-up with his business and said that he was about ready to park his truck and look for a job. He complained about the competition, and the economy…and said he wasn’t even making enough money to pay for the insurance. He finished, obviously exasperated, and asked “how should I price my services”…he was sure that was the problem.

All too often towers believe that pricing their services properly is the hardest part. Some think they have to be the low-price leader, others ride the middle, while others charge what they’re worth and are able to grow their businesses.

But how does this last group do it? What is it that these guys get that the rest of us don’t?

They understand that charging less than what you’re worth is caused by fear and fear is a poison that will ultimately kill your business. They know that if you’re using fear as a factor in determining your rates, you’ll shoot too low and miss.

If the fear of losing out on a tow causes you to price your services— too low to pay the bills…you need to change your strategy. Instead of focusing on not-losing you need to focus on winning…on charging rates that get you excited…excited enough to get in your truck and get going.

But how do you do that? Especially when you live in the real world…where there’s bills to be paid and people who want to steal your customers?

There are 4 factors that determine your success in the marketplace. Supply, Demand, Quality, and Quantity. Many towers believe they don’t have any control over the first two. They say “It’s because supply (competition) is too high that demand is too low.” And each firmly believes that they’ve got “quality service” wrapped-up. But what many fail to understand is the last one, quantity, and how it can help you to compete while increasing your bottom line.

Here’s a simple yet practical pricing strategy to help you understand. This should only be used as a framework from which to begin. You must determine your rates based on the service provided.

1. Cost of Doing Business – Add up all of last year’s expenses, everything that’s considered a cost of doing business. Fuel, rent, advertising, insurance, repairs & maintenance, tires, employee expense, damages, office supplies, utilities, and phones. Add in the interest paid on trucks and real estate. And then divide that number by the number of calls you did that year. For example: If the total cost was $100,000 and you ran 4000 calls, then your cost per call would be $25. ($100,000/4000=$25)

2. Determine your expected Return On Investment – Add up the value of your trucks & equipment and real estate, or a percentage of real estate that’s used solely for the purposes of conducting business. Include taxes paid on both. For our example we’ll assume it all comes to $500,000. After you know what your investment is you need to then decide what kind of return you want. If you want a 10% ROI then multiply that number by 10% ($500,000 X 10% = $50,000) then divide the result by the number of calls you did last year ($50,000/4000=$12.50)

3. Trucks and Equipment Replacement- Your truck is considered an asset and it will have value when you trade or sell, but it must also be considered an expense. This is hard for many to wrap their heads around. Each mile you put on your trucks, and every time you use your equipment, you lose value. Besides the wear and tear factor it’s also slowly becoming obsolete. As better, more technologically advanced trucks and equipment become available, yours are becoming less and less sought after. Think about it like a carpenter replacing a table saw. 8 hours per day for 500 days can take its toll. When it’s time to replace it he’ll be looking for something that’ll hold up better, not something that’s already worn out. So you must work the cost of replacing this stuff into your cost per call. To cover the cost of replacement I suggest you go by the $1 per mile rule. In other words if you drive 60,000 miles in one year then you need to collect $60,000 from the 4000 calls that you did. ($60,000/4000=$15)

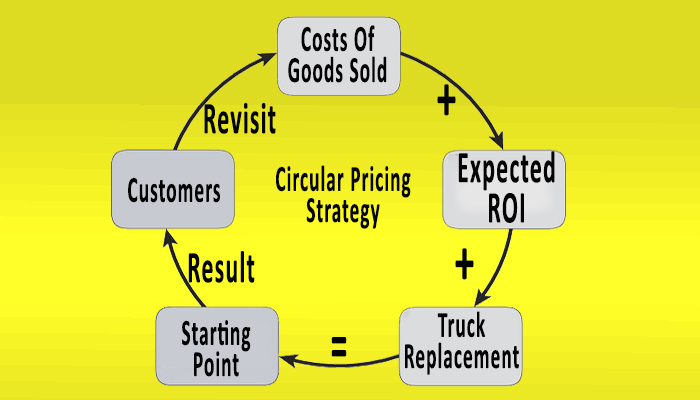

4. Then add these 3 numbers together and you have a good starting point. Some calls will be higher some will be lower, this will give you an average to shoot for.

(Cost of Doing Business + ROI + Truck Replacement = Starting point)

Just know that you control your costs, nowhere is it written that you must toe-the-line and keep incurring costs that do nothing to serve you, your customers, and increased profits. If it’s not working for you—make a change and make it work.

Nowhere is it written that you must toe-the-line and keep incurring costs that do nothing to serve you, your customers, and increased profits

So where does quantity come into the equation?

Once you’ve considered all the costs and know that your rates will sustain your desired profit you’ll become more confident. And when you know you’re making a profit your fear will all but disappear. The residual effect will be that you’ll get more customers. No longer will you be that scared guy…cold-calling repair shops begging for work, you’ll be happy and helpful in all areas because you know your numbers. And because positivity attracts, you’ll get more work.

But that’s not even the best part.

When you increase the number of customers you’re serving, you can revisit your pricing strategy. And…If you choose to, you’ll be able to lower your rates while maintaining your desired profit. With lower rates you’ll be more competitive and have the opportunity to help more and more people, creating a snowball effect. Of course some of your variable costs will increase, but so will your income. And yes you’ll drive more miles but you’ll still be capturing replacement costs.

Whatever method you use to determine your rates, remember to never let fear play a part and know that you control your numbers.

I stumbled across this article searching for different ways to bill insurance company’s. I’m a new business owner of T-1 Roadside Service. It’s my first year in business. I’d like to learn more about your strategies on building a successful towing company.

Tevis, Thanks for commenting. I spoke with you the other day and I believe you have the information you need for now. Let me know if I can assist further. Thanks

I just starting watching your videos they’re really knowledgeable. I’m a new business owner and I would love to talk to and learn from your advices.

Thank you for posting your article. We are researching everything so that it can be included in our business plan as well as office protocols as a start up still in the planning phase this information is valuable.